What Is The Tax Rate In San Mateo County . The current total local sales tax rate in san mateo, ca is 9.625%. The san mateo county sales tax is 0.25%. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state sales tax and 2.75% san mateo county local sales. San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. Look up 2024 sales tax rates for san mateo county, california. The current sales tax rate in san mateo county, ca is 9.88%. San mateo, ca sales tax rate. The 9.625% sales tax rate in san mateo consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.25% san mateo tax and. Tax rates provided by avalara are updated regularly. The december 2020 total local. Summary of valuations of property in the. The sales tax rate in san mateo. Click for sales tax rates, san mateo county sales tax calculator, and printable sales. The tax rates and valuation of taxable property of san mateo county publication includes:

from www.sbpsd.org

Tax rates provided by avalara are updated regularly. The san mateo county sales tax is 0.25%. San mateo, ca sales tax rate. The 9.625% sales tax rate in san mateo consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.25% san mateo tax and. The current total local sales tax rate in san mateo, ca is 9.625%. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state sales tax and 2.75% san mateo county local sales. San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. The december 2020 total local. The sales tax rate in san mateo. Look up 2024 sales tax rates for san mateo county, california.

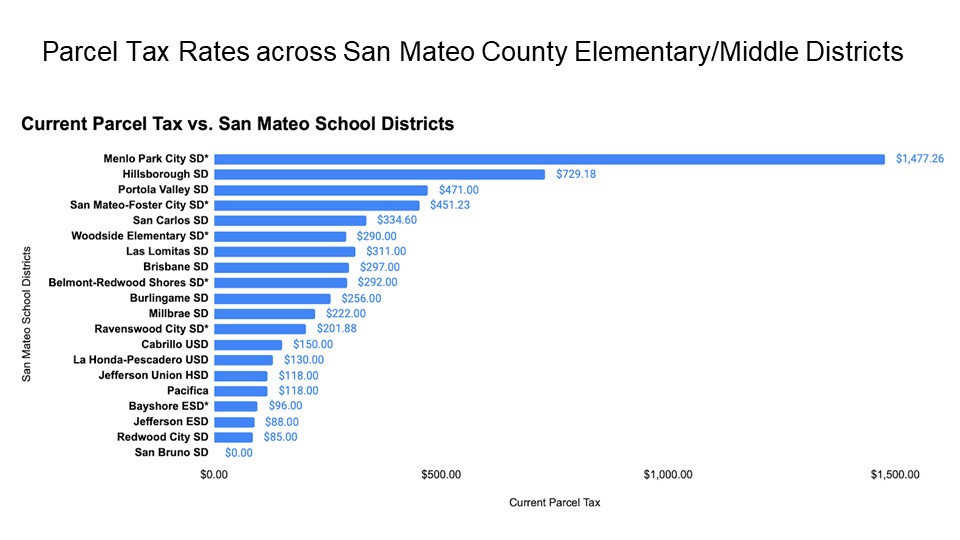

Parcel Tax Information San Bruno Park School District

What Is The Tax Rate In San Mateo County Summary of valuations of property in the. San mateo, ca sales tax rate. The current sales tax rate in san mateo county, ca is 9.88%. Click for sales tax rates, san mateo county sales tax calculator, and printable sales. The current total local sales tax rate in san mateo, ca is 9.625%. The san mateo county sales tax is 0.25%. The december 2020 total local. The sales tax rate in san mateo. Summary of valuations of property in the. Look up 2024 sales tax rates for san mateo county, california. The 9.625% sales tax rate in san mateo consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.25% san mateo tax and. San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state sales tax and 2.75% san mateo county local sales. The tax rates and valuation of taxable property of san mateo county publication includes: Tax rates provided by avalara are updated regularly.

From amandahany.blogspot.com

Everything You Need To Know About San Mateo County Property Tax In 2023 What Is The Tax Rate In San Mateo County The current total local sales tax rate in san mateo, ca is 9.625%. The san mateo county sales tax is 0.25%. Click for sales tax rates, san mateo county sales tax calculator, and printable sales. The tax rates and valuation of taxable property of san mateo county publication includes: San mateo county, located in western california, has sales tax rates. What Is The Tax Rate In San Mateo County.

From www.niche.com

2023 Best Places to Retire in San Mateo County, CA Niche What Is The Tax Rate In San Mateo County The tax rates and valuation of taxable property of san mateo county publication includes: The sales tax rate in san mateo. Tax rates provided by avalara are updated regularly. Summary of valuations of property in the. San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. The san mateo county, california sales tax is. What Is The Tax Rate In San Mateo County.

From climaterwc.com

San Mateo County voters to consider transportation sales tax measure in What Is The Tax Rate In San Mateo County The sales tax rate in san mateo. Click for sales tax rates, san mateo county sales tax calculator, and printable sales. The san mateo county sales tax is 0.25%. Summary of valuations of property in the. San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. The current sales tax rate in san mateo. What Is The Tax Rate In San Mateo County.

From www.dreamstime.com

Map of San Mateo County in California, USA Stock Illustration What Is The Tax Rate In San Mateo County The december 2020 total local. Tax rates provided by avalara are updated regularly. The 9.625% sales tax rate in san mateo consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.25% san mateo tax and. The current total local sales tax rate in san mateo, ca is 9.625%. The current sales tax rate in san mateo. What Is The Tax Rate In San Mateo County.

From crimegrade.org

The Safest and Most Dangerous Places in San Mateo County, CA Crime What Is The Tax Rate In San Mateo County The san mateo county sales tax is 0.25%. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state sales tax and 2.75% san mateo county local sales. Tax rates provided by avalara are updated regularly. The current total local sales tax rate in san mateo, ca is 9.625%. The 9.625% sales tax rate in san. What Is The Tax Rate In San Mateo County.

From shop.govdocs.com

San Mateo County, CA Poster Package What Is The Tax Rate In San Mateo County The current sales tax rate in san mateo county, ca is 9.88%. The current total local sales tax rate in san mateo, ca is 9.625%. The tax rates and valuation of taxable property of san mateo county publication includes: Click for sales tax rates, san mateo county sales tax calculator, and printable sales. The san mateo county sales tax is. What Is The Tax Rate In San Mateo County.

From complianceposter.com

San Mateo County, CA Minimum Wage Poster Compliance Poster Company What Is The Tax Rate In San Mateo County Look up 2024 sales tax rates for san mateo county, california. The december 2020 total local. The current total local sales tax rate in san mateo, ca is 9.625%. San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state. What Is The Tax Rate In San Mateo County.

From polymes.com

San Mateo Property Tax Guide & Rates 2023 What Is The Tax Rate In San Mateo County Summary of valuations of property in the. The december 2020 total local. The current sales tax rate in san mateo county, ca is 9.88%. The sales tax rate in san mateo. The san mateo county sales tax is 0.25%. San mateo, ca sales tax rate. Click for sales tax rates, san mateo county sales tax calculator, and printable sales. The. What Is The Tax Rate In San Mateo County.

From www.neilsberg.com

San Mateo County, CA Median Household By Race 2024 Update What Is The Tax Rate In San Mateo County San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. Look up 2024 sales tax rates for san mateo county, california. Click for sales tax rates, san mateo county sales tax calculator, and printable sales. The current sales tax rate in san mateo county, ca is 9.88%. Summary of valuations of property in the.. What Is The Tax Rate In San Mateo County.

From ottomaps.com

San Mateo County Map SOUTH with MLS Areas Otto Maps What Is The Tax Rate In San Mateo County San mateo, ca sales tax rate. The tax rates and valuation of taxable property of san mateo county publication includes: The current total local sales tax rate in san mateo, ca is 9.625%. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state sales tax and 2.75% san mateo county local sales. Click for sales. What Is The Tax Rate In San Mateo County.

From autosdoggy.weebly.com

autosdoggy Blog What Is The Tax Rate In San Mateo County San mateo, ca sales tax rate. The tax rates and valuation of taxable property of san mateo county publication includes: San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. The current total local sales tax rate in san mateo, ca is 9.625%. The december 2020 total local. Click for sales tax rates, san. What Is The Tax Rate In San Mateo County.

From www.smccd.edu

Trustee Area 3 Board Vacancy Board of Trustees San Mateo County What Is The Tax Rate In San Mateo County Click for sales tax rates, san mateo county sales tax calculator, and printable sales. The current sales tax rate in san mateo county, ca is 9.88%. The tax rates and valuation of taxable property of san mateo county publication includes: The december 2020 total local. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state. What Is The Tax Rate In San Mateo County.

From sarreporter.weebly.com

Blog Archives sarreporter What Is The Tax Rate In San Mateo County The sales tax rate in san mateo. The december 2020 total local. The 9.625% sales tax rate in san mateo consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.25% san mateo tax and. Summary of valuations of property in the. The current total local sales tax rate in san mateo, ca is 9.625%. The current. What Is The Tax Rate In San Mateo County.

From www.pinterest.com

Infographic San Mateo County Home Sales Statistics November 2017 What Is The Tax Rate In San Mateo County San mateo, ca sales tax rate. The san mateo county sales tax is 0.25%. San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. The tax rates and valuation of taxable property of san mateo county publication includes: The december 2020 total local. The current total local sales tax rate in san mateo, ca. What Is The Tax Rate In San Mateo County.

From islandtaxcalculator.blogspot.com

San Mateo Tax Collector Property Tax What Is The Tax Rate In San Mateo County San mateo, ca sales tax rate. The sales tax rate in san mateo. The current sales tax rate in san mateo county, ca is 9.88%. The current total local sales tax rate in san mateo, ca is 9.625%. Look up 2024 sales tax rates for san mateo county, california. Tax rates provided by avalara are updated regularly. The december 2020. What Is The Tax Rate In San Mateo County.

From chpc.net

San Mateo County Housing Need Report 2023 California Housing Partnership What Is The Tax Rate In San Mateo County The current total local sales tax rate in san mateo, ca is 9.625%. Look up 2024 sales tax rates for san mateo county, california. San mateo, ca sales tax rate. The san mateo county sales tax is 0.25%. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state sales tax and 2.75% san mateo county. What Is The Tax Rate In San Mateo County.

From www.facebook.com

🔴 San Mateo County is... County of San Mateo Government Facebook What Is The Tax Rate In San Mateo County The current total local sales tax rate in san mateo, ca is 9.625%. The san mateo county, california sales tax is 8.75% , consisting of 6.00% california state sales tax and 2.75% san mateo county local sales. San mateo, ca sales tax rate. San mateo county, located in western california, has sales tax rates ranging from 9.375% to 9.875%. The. What Is The Tax Rate In San Mateo County.

From www.sfchronicle.com

Property taxes due Monday in San Mateo County; SF deadline in flux What Is The Tax Rate In San Mateo County The san mateo county sales tax is 0.25%. The current sales tax rate in san mateo county, ca is 9.88%. The sales tax rate in san mateo. Look up 2024 sales tax rates for san mateo county, california. The current total local sales tax rate in san mateo, ca is 9.625%. The san mateo county, california sales tax is 8.75%. What Is The Tax Rate In San Mateo County.